Support for active ownership as ESG approach is declining

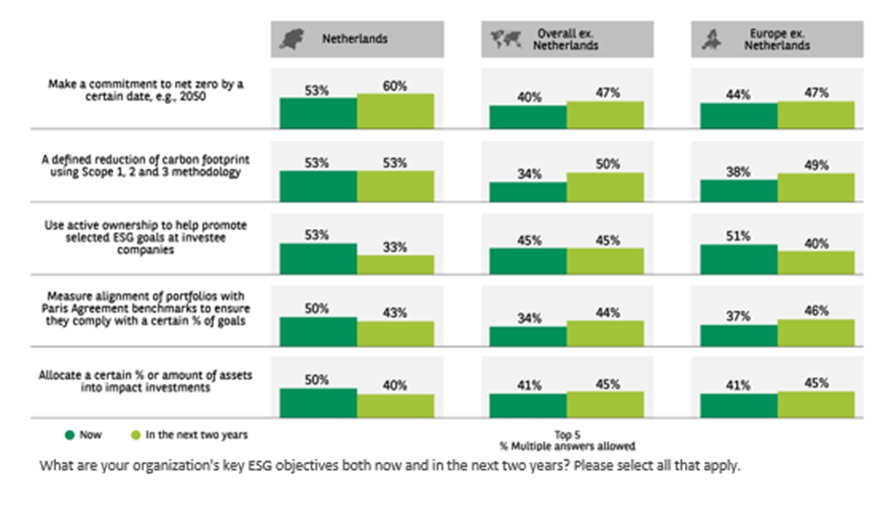

Among Dutch investors, the popularity of active ownership as a means to promote ESG goals at investee companies is declining. The number of Dutch institutional investors that name active ownership as a key ESG objective has decreased from 53% to 33%. This became apparent in the recently published biennial ESG Global Survey by BNP Paribas. The research report discusses the strategies that institutional investors over the world apply to become more sustainable and the obstacles they face in this process.

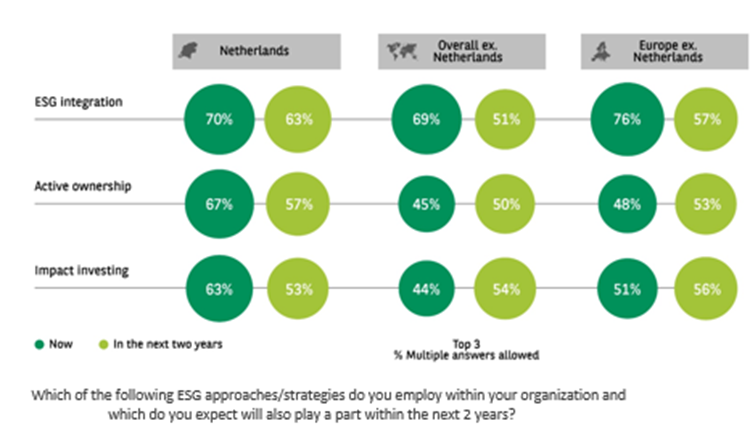

More often than their international peers, Dutch investors say they apply active shareholding as an ESG strategy. However, the study demonstrates that they will be losing their position as front-runners over the next two years. In addition to active ownership, support for ESG integration and impact investments is also expected to fall over the coming two years. A potential explanation might be that respondents perceive ESG integration as a hygiene factor and therefore self-evident.

Globally, the active ESG approach is gaining popularity

The survey shows that globally, 41% of investors have set themselves the goal of reducing net carbon emissions to zero by a certain date, such as 2050. In two years, this will be almost half (47%) of investors. In recent years, institutional investors have picked the ‘low-hanging fruit’ by using sustainability criteria to exclude the worst-performing companies from investments. These exclusions are a passive ESG approach. The next step in making portfolios more sustainable is switching to active investment strategies, such as impact investing, thematic investing and active ownership.

The question is how this trend will develop in the future. The Netherlands is seen as a pioneer in the field of sustainable investing, so it is questionable whether the move away from active ownership will also attract followers in the rest of the world. Time and the results of the next ESG Global Survey will tell.

About the ESG Global Survey 2023

BNP Paribas releases the ESG Global Survey every two years. This research focuses on how institutional investors from Europe, the APEC, and North America are faring on the path to sustainability. In 2023, the focus was on the strategies that institutional investors apply to invest sustainably and the obstacles they encounter. A total of 420 respondents worldwide participated, including 30 Dutch institutional investors.