Culture of innovation helps Dutch economy to mitigate climate risks

The Dutch economy is vulnerable to the effects of climate change, but as a sustainability frontrunner it is relatively well positioned to mitigate the cost pressure of the energy transition. BNP Paribas reached this conclusion based on a selection of climate indicators from MSCI ESG Research, such as the economy’s exposure to the fossil fuel sector, the carbon intensity of business activities and revenue from sustainable business activities1.

MSCI data shows that the carbon intensity of Dutch companies is almost 50% lower than the average for developed markets. This makes the Dutch economy less vulnerable to energy transition risks. This limited exposure is notable because a relatively large share of Dutch GDP is generated in sectors with a high climate impact, such as agriculture, energy and industry. These results may indicate that due to the implementation of sustainable innovations the Netherlands, has a smaller carbon footprint than international competitors in carbon-intensive sectors.

Managing risks for centuries

The Netherlands’ centuries-long struggle with water has contributed to the realization that climate control requires cooperation and reliable public administration. With 59% of the Dutch territory at risk of flooding2, it is natural for the Dutch to spend billions on mitigating a risk that does not affect all residents equally. To meet new, stricter water safety standards by 2050, dikes, flood defenses and dams will need to be strengthened. The costs of these measures have been increased several times, in part due to climate change.

When BNP Paribas assesses the credit rating of its clients, the ‘country risk’ is an important factor. The ability of local governments to reduce the impact of climate change is taken into account when determining this risk. Consistent government policy and a longer-term vision will result in a lower risk. To estimate the annual expected climate damage, BNP Paribas combines various data. For instance, it uses data from the World Resources Institute (WRI) and the valuation of assets located in potential flood plains to map flood risks.

A sum of risks

In its assessment of physical climate risks, BNP Paribas also examines the direct effects of global warming. Like the calculation of flood risk, BNP Paribas developed a heat model using labor productivity as a benchmark. In this initial concept for measuring heat risk, a heat indicator of 32°C is used to provide a measure of productivity loss. The model is planned to differentiate by sector and region in the future.

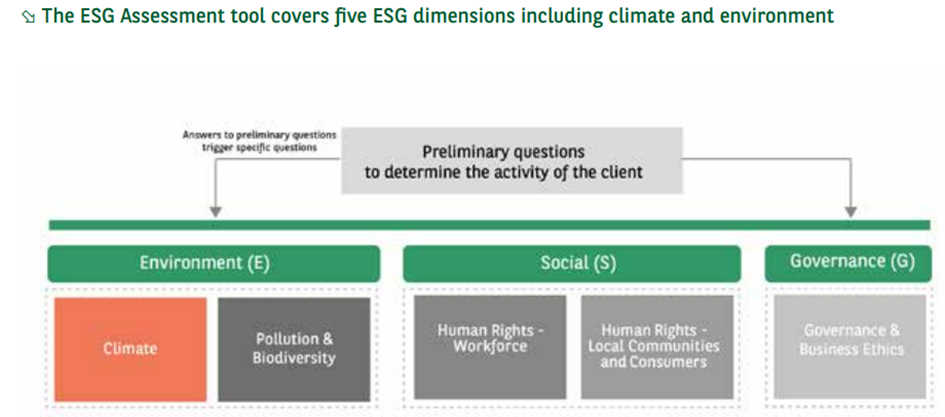

In addition to analyzing macro data from external sources, BNP Paribas evaluates the individual risks of its clients using its own ESG assessment tool. It rates how well clients are prepared for ESG challenges and systematically assesses climate issues throughout the credit chain.

Rado Georgiev, strategic adviser sustainability at BNP Paribas Nederland: “The implementation of ESG assessment across all business sectors provides BNP Paribas with an overview of significant ESG risks, including transition risks. The assessment covers relevant areas of a company’s climate change policy and strategy, risk management, performance indicators and targets. BNP Paribas uses the results to adapt its credit policy and its sector and country ESG risk map.”

[1] MSCI is a global investor data services company and index provider

[2] According to data of the PLB Netherlands Environmental Assessment Agency